ProjectionLab has been getting another round of attention in the personal-finance conversation as more do-it-yourself investors compare detailed retirement scenarios, tax outcomes, and life-event trade-offs without handing over account logins. The product sits in a busy corner of the market—part forecast, part stress test—yet it keeps resurfacing because it offers a level of modeling detail that many mainstream calculators flatten into a few sliders.

In that context, “financial planning tool explained” has become a practical demand rather than a slogan, especially as new households combine finances, rates and taxes shift, and early-retirement timelines collide with volatile markets. ProjectionLab’s public materials lean into simulation—year-by-year outputs, alternative strategies, and uncertainty ranges—rather than a single, tidy retirement date.

Why it is in the news cycle

A tool that keeps getting name-checked

ProjectionLab’s presence in public conversation has been boosted by a pattern of casual endorsements and comparisons from recognizable personal-finance voices, including references displayed by the company itself. On its “About” page, ProjectionLab includes mentions from outlets and personalities associated with the FIRE community, along with short descriptions of why the tool is being used.

Those mentions frame it as something closer to a full model than a simple retirement calculator, and the references tend to focus on flexibility and clarity rather than a promise of specific returns. A tool that is repeatedly cited as “new-ish” or unusually capable can pick up renewed curiosity when people revisit assumptions after a big life decision.

The solo-build origin story

ProjectionLab has tied part of its identity to the way it was made. The company’s public “About” page says the product began in 2021, built by Kyle as a solo developer with the goal of making a financial and retirement planning tool that is “actually fun to use.”

The messaging also functions as a signal about maintenance. ProjectionLab’s own materials describe it as evolving over the past four years and now supported by a “small and nimble team,” a line that implicitly addresses a common user worry—whether a planning tool will still be around after the hard work of building a plan.

“Build in public” as a credibility strategy

Subscription software often asks users to trust what they cannot see: the backlog, the fixes, the roadmap. ProjectionLab’s pricing page says the product is built “in public” and that subscriptions fund ongoing development, describing an approach shaped through feedback from people who use it frequently.

ProjectionLab’s public materials also point readers toward a release history and a public roadmap, suggesting that product changes are meant to be legible rather than hidden behind periodic marketing pushes.

DIY users and professional use-cases

ProjectionLab presents itself as a personal tool first, but it also keeps a door open to professional settings. The “About” page links to a Pro version for advisors, as well as a financial wellness angle aimed at employers that might offer access as a benefit.

The product’s public positioning does not erase the tension. A tool optimized for self-directed households can feel too granular for someone seeking a quick answer, yet the same detail can be a selling point in advisor contexts where clients demand to see how assumptions translate into year-by-year outcomes.

“Financial planning tool explained” demand

The renewed interest around ProjectionLab reflects a broader fatigue with black-box planning outputs. ProjectionLab’s own homepage language emphasizes experimentation—identifying trade-offs, backtesting against historical data, and trying different strategies and account types—suggesting that the tool expects users to interrogate results, not just accept them.

That tone is part of why “financial planning tool explained” keeps surfacing in conversation around the product. The request is less “what is it” than what the software is doing when it draws a clean line across decades of someone’s finances.

What ProjectionLab is modeling

A life model rather than a snapshot

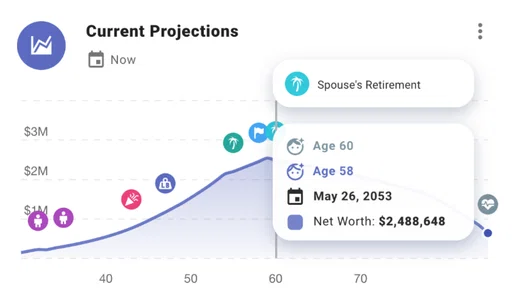

ProjectionLab’s own homepage describes a “living model” of a user’s finances designed to cover an entire lifetime, with the ability to drill into each simulated year in detail. That year-by-year framing matters because many planning tools compress time into averages, even when cash flow and taxes behave unevenly across a working career, early retirement, and later-life distributions.

The product’s public messaging also highlights net worth projection as a core output, alongside progress tracking. For some users, “financial planning tool explained” starts with that simple visibility: sequences instead of totals.

Goals, milestones, and trade-offs

ProjectionLab’s public materials repeatedly return to trade-offs. The homepage talks about identifying trade-offs and experimenting with different contribution orders and drawdown options, language that suggests the tool is built to handle competing objectives rather than a single retirement target.

A review from The College Investor describes ProjectionLab as a simulator for future financial scenarios with user-controlled inputs and visualizations that show possible outcomes and alternative paths. In that sense, the tool’s value is less about prediction and more about revealing which assumptions are doing the work.

Monte Carlo and the “chance of success” posture

ProjectionLab’s marketing materials highlight Monte Carlo simulation as a way to gauge the spectrum of possible outcomes, and the “About” page points to “Chance of Success” as a named capability. Rather than offering a definitive answer, the product frames results as a range shaped by volatility and return sequences.

The Mad Fientist’s description of ProjectionLab also points to Monte Carlo and historical backtesting, describing customizable methodology and the option to experiment with probability distributions. That kind of control can be attractive to users who distrust default assumptions, but it also shifts responsibility: better knobs do not guarantee better forecasts.

Tax analytics as a differentiator

Taxes are often the part of planning that gets simplified away, even when outcomes hinge on timing and account type. ProjectionLab’s homepage lists estimated tax analysis and effective tax brackets as drill-down outputs, and its “About” page links to tax analytics as a product area.

External reviewers also cite tax tools as part of the appeal. The College Investor review points to tax analysis as a feature, while noting that time is required to understand the software.

Cash flow, drawdown, and the messy middle

Retirement planning tends to treat retirement itself as the main event, but many households spend years in a messy middle: uneven expenses, debt payoff, or purchases that disrupt saving. ProjectionLab’s homepage emphasizes cash-flow analysis and drawdown detail, alongside experimentation with drawdown options and portfolio blends.

The Mad Fientist’s write-up points to Sankey-style cash-flow visuals, an attempt to make complicated flows legible without collapsing everything into one number. This is where the “financial planning tool explained” request becomes concrete, because the details often live in the cash-flow plumbing.

Data, privacy, and control

The deliberate lack of account connections

Many finance products have moved toward automatic account syncing, treating aggregation as the main convenience. ProjectionLab, by contrast, publicly highlights that users do not need to connect financial accounts, and it frames that as a positive.

The College Investor review notes that ProjectionLab cannot directly connect to accounts for live tracking, a point that can matter for users who want ongoing monitoring rather than periodic plan revisions.

“We never sell your data” positioning

ProjectionLab’s pricing page makes privacy a central selling point, stating that it never sells user data and contrasting that with free apps that rely on ads or data sales to make money. It also argues that independence from outside funding leads to better decisions and a better experience, linking business model to product incentives.

That positioning carries extra weight in finance because the underlying data—income, assets, liabilities, taxes—can be uniquely sensitive. ProjectionLab’s public record leans on the idea that privacy is part of the product, not a checkbox in the footer.

Control over storage and portability questions

A recurring anxiety in planning software is what happens to a plan over time: whether it can be exported, whether it can be moved, whether the user can preserve a model through a job change. ProjectionLab’s homepage includes “control where your data is saved” as a listed capability, presenting it as a differentiator in a market where many tools assume the default is the vendor’s cloud.

Even without deep technical detail in the marketing copy, the signal is clear. The plan is meant to feel like the user’s asset, not just an input stream feeding a company’s analytics.

Couple planning and household complexity

Financial plans are often built for individuals, then awkwardly merged. ProjectionLab’s homepage includes “plan as a couple” among its listed features, a small line that hints at an entire design problem—two incomes, two sets of accounts, uneven timelines, and shared expenses that evolve.

The “About” page also includes user commentary describing modeling questions like moving to a higher-tax state and testing how choices change outcomes. Those examples point to a reality many tools understate: the plan is often a negotiation between people, not a solitary spreadsheet exercise.

International users and the limits of public clarity

ProjectionLab’s homepage lists currency choice and international account types, and the “About” page includes a user line praising tax settings for countries beyond the United States. Those cues suggest the tool is not built solely around one jurisdiction, though public-facing materials do not spell out depth of coverage for every region.

Still, the decision to surface international features at all is notable in a market where many planning tools assume U.S.-centric defaults. It also explains why “financial planning tool explained” appears in conversations among globally dispersed users: the math is only half the question if the assumptions do not map cleanly to local rules.

How it fits in the market

Pricing signals and the free on-ramp

ProjectionLab’s pricing page argues that subscriptions directly fund ongoing development and positions the product as independent from advertisers and investors. The company also frames pricing in contrast to traditional financial planning that can cost thousands per year, presenting the tool as a way to access detailed modeling without the professional fee structure.

Public-facing materials also emphasize a low-friction entry. The pricing link snippet states users can get started for free with no sign-up or credit card required, and the homepage lists monthly, annual, or lifetime pricing as options once users move beyond the free experience.

The Personal Capital comparison keeps surfacing

ProjectionLab is frequently framed against older, widely known tools. On the “About” page, one highlighted comparison describes it as “like Personal Capital’s Retirement Planner” but significantly more powerful, a line repeated across the company’s public materials.

That comparison points to an audience that has used mainstream dashboards and wants the next layer: more scenario control, more clarity on taxes and sequences, fewer forced simplifications. In that framing, “financial planning tool explained” becomes a demand for method, not marketing.

Advisors, employers, and institutional adoption

ProjectionLab’s “About” page points toward advisor usage and financial wellness programs, suggesting a strategy that goes beyond individual subscriptions. The public record does not detail every operational feature, but it indicates that the Pro version is meant for advisors and that the product can be shared as an employee benefit.

That expansion changes the stakes. When a tool is used informally at home, users can tolerate rough edges; in institutional contexts, procurement and compliance concerns sharpen, and the demand for consistent outputs becomes more intense.

Missing conveniences and deliberate trade-offs

Planning tools tend to converge on feature checklists, yet the real differentiators are often the absences. ProjectionLab’s public materials celebrate not requiring account connections, but that also means a user has to keep the model updated.

The College Investor review explicitly notes the lack of direct account connectivity for live tracking, describing it as a con even while praising customization and statistical approaches. The trade-off is likely to stay central as the tool’s audience broadens.

What the public record can’t settle

ProjectionLab’s marketing language is confident about capability—Monte Carlo, backtesting, tax analytics, cash-flow detail—but the public record does not provide a single authoritative standard for how any planning tool should be validated. Simulations can be built on reasonable assumptions and still diverge sharply based on user inputs, and “chance of success” numbers can be interpreted as certainty when they are not.

That ambiguity is one reason “financial planning tool explained” continues to be asked in a reporting context. The demand is not for promotional claims or blanket skepticism, but for a clear read of what is known from public materials and what remains a matter of user judgment: how assumptions are set, how often models are updated, and how simulated years get translated into real decisions.

Conclusion

ProjectionLab’s recent visibility reflects a familiar pattern in consumer finance: when markets feel unstable and life plans feel negotiable, the public gravitates toward tools that make uncertainty visible rather than pretending it can be removed. The company’s public record emphasizes simulation across an entire life, with the ability to examine taxes, cash flow, and drawdown year by year, and to stress-test outcomes through Monte Carlo and historical backtesting.

But the same material also shows what is not resolved. ProjectionLab presents privacy and independence as core attributes, arguing it does not sell user data and that subscriptions fund ongoing development, yet the practical meaning of “control” still depends on how a user maintains a model over time and what they assume about the future.

For readers coming to “financial planning tool explained” expecting definitive answers, the record is mixed. ProjectionLab appears built to clarify trade-offs and expose sensitivity to assumptions, not to deliver certainty, and even favorable coverage flags missing conveniences like live account connectivity.

The open question is how far that approach can scale—from a tool praised for nuance by self-directed users into a broader market that often rewards simplicity—and whether the product’s community-shaped posture can hold as expectations rise and the audience changes.